State of Dutch Tech 2024, Three Problems

Introduction

Are you thinking about starting a company in the Netherlands? Or are you already a founder with the dream to upend industries? Or maybe you are dreaming of a job in a high-growth company while biking along the endless canals on the weekends?

In all these cases, and probably a number of more, you should check the State of Dutch Tech report by teachleap.nl (download here). In this post, I will highlight three major problems it points to. In an upcoming post I will look at three solutions it suggests.

First things first: I want to give chapeau to techleap.nl (no affiliation). They are doing great work to continuously evaluate and accelerate the tech-ecosystem in the Netherlands. The report is detailed, yet readable. Well done! Now, for the summary, because, as you may have guessed, acceleration is badly needed.

Problem 1: Dutch startups fail to grow

Startups are great, but they are not very profitable. It is only as companies grow and expand their market share and customer base that they generate attractive returns for their founders and investors. It is also these companies that create substantial employment and give their employees a chance to acquire skills and experience needed to found another high-growth company in the future. So yes, sure startups are great, but you know what is even better? Startups that grow. Unfortunately, the Dutch startups don’t.

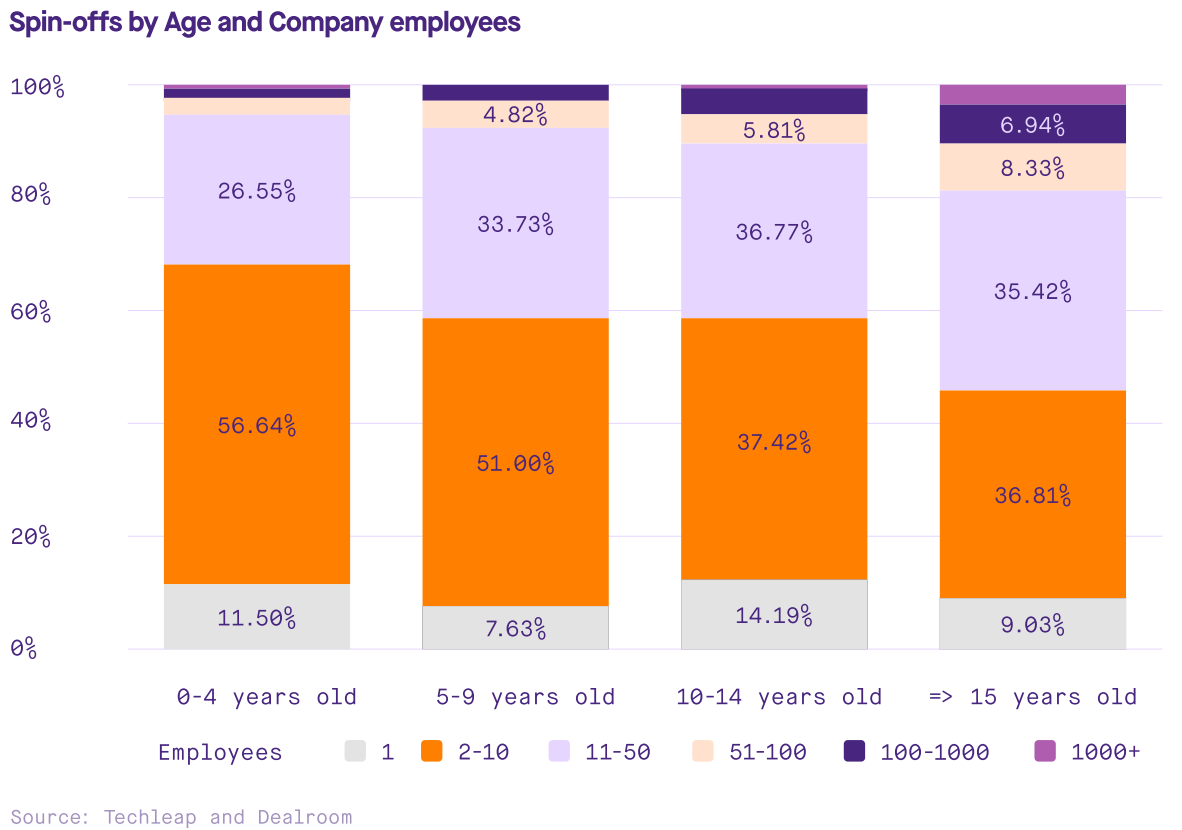

Here are some sobering stats from the report: more than 70% of all Dutch startups will never exit the seed stage, and only 19% of them will ever receive more than 10M EUR in funding. The Dutch are already not a champion in generating patents or turning patents into research-based startups (spin-offs). Even if formed, these spin-offs don’t grow either. Nearly 50% of Dutch spin-off companies that survive 15 years have less than 10 employees and only 18% have above 50. After these 15 years, 60% of spin-offs were still privately held. Dreaming of impacting the world with application of your research? Then you may have to wake up.

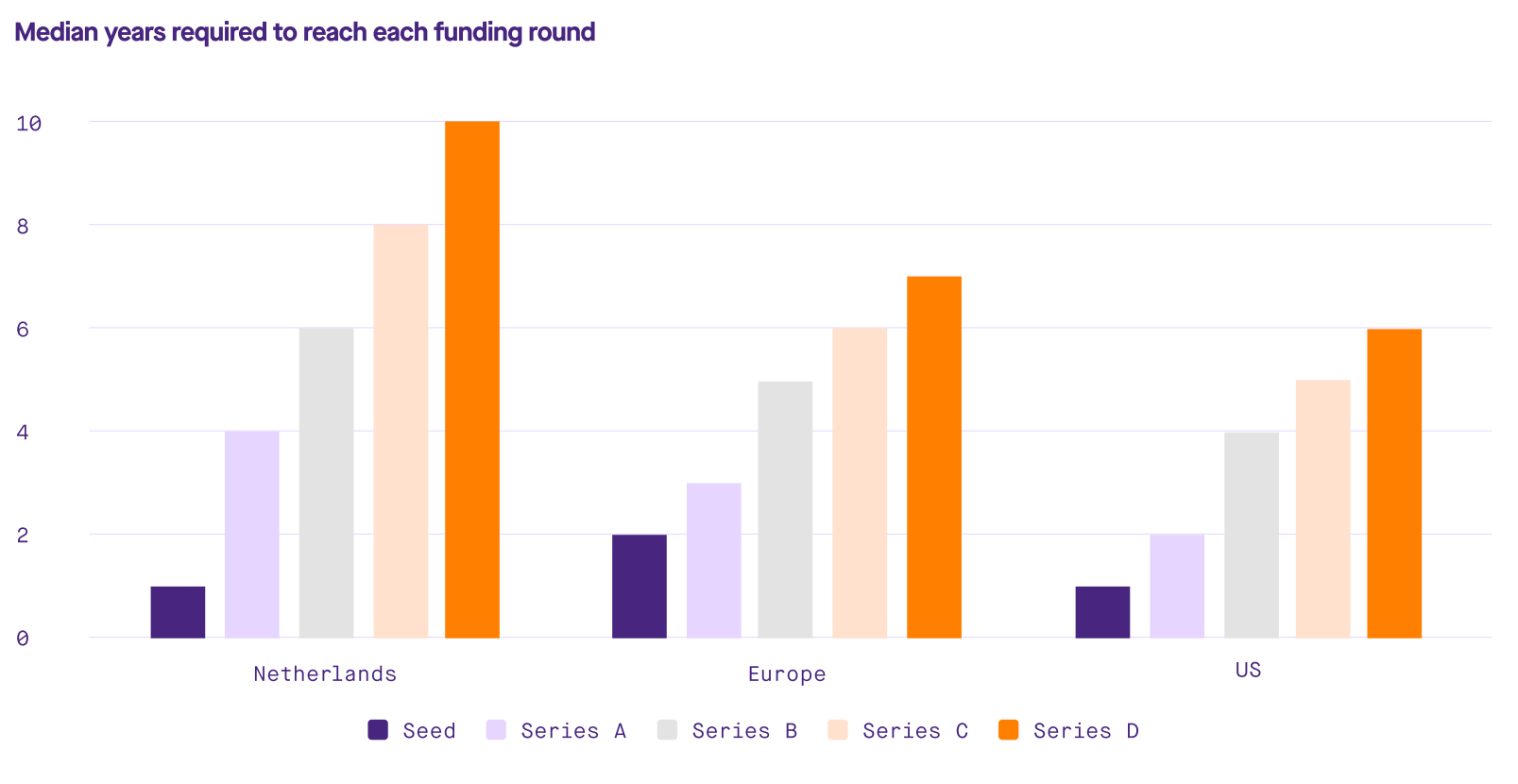

Unfortunately, chances of you making it big as a founder in the Netherlands are relatively slim. As it turns out, even if you are one of the lucky ones who gets to grow, it will be slow. Median time to reach series A in the Netherlands (4 years) is double that of the US. The time to reach series C is 8 years, which is 3 and 2 years longer than in the US and EU respectively.

Problem 2: Big money is hard to get (in NL)

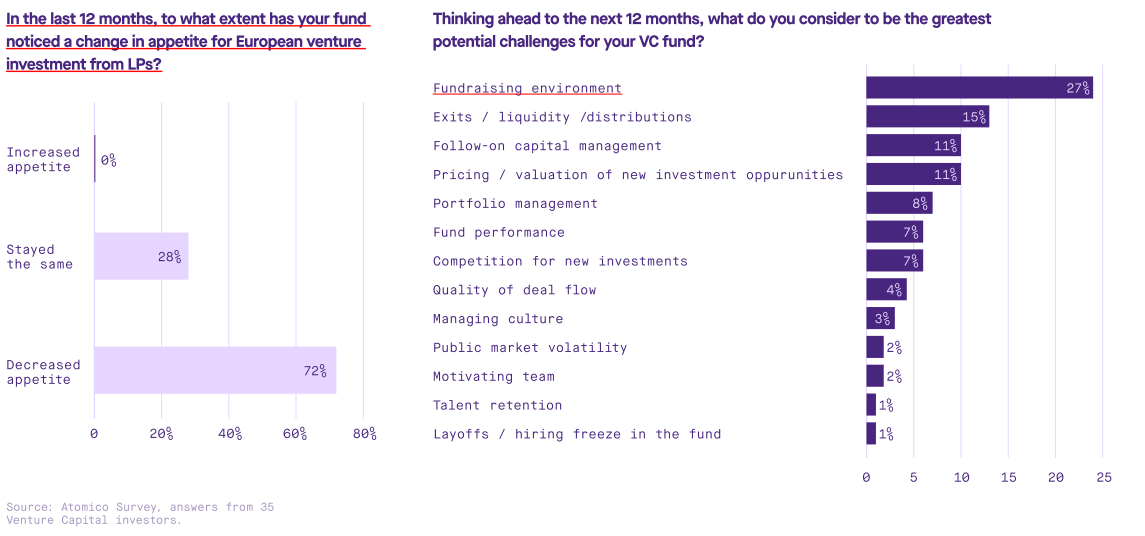

It is not any news that European VC funding is lagging the US one. The EU’s per capita VC investment is one eighth of that in the US and the Netherlands is not an outlier. It is getting better, but only very slowly. Additionally, 2023 was not an easy year, with VC funding experiencing a drop of 36% and 38% in the EU and US respectively. Many VCs report LPs delaying or reducing investments. Consequently, the Dutch and European VCs are cautious. That’s exactly the opposite of what Europe needs.

This has several consequences. First, scarcity of capital makes it yet harder for companies to scale. Second, it creates more opportunities for foreign, non-European (e.g. US or Chinese), capital to enter the picture. While this is not immediately a bad thing, it does mean that part of the value created by successful companies will be captured outside of Europe, only exacerbating the problem in the future. In fact, between 2019 and 2023, 85% of all growth equity in the Netherlands included a foreign investment already.

While big money is never easy to get, it is harder in the Netherlands than some other places in Europe and certainly much harder than it is in the US. In the Netherlands, only 1.3% companies raised 100+M EUR investments, whereas this is 2.8% in Germany, 2.1% in Switzerland and 1.9% in the UK. Maybe the lack of big money in the Netherlands should not be a surprise given that the phrase “going Dutch” has been around since the 17th century?

Problem 3: The Netherlands is not a top destination for global talent

The US has high salaries, the UK has a global metropolis and the comfort of an English-speaking country, Ireland has low taxes, Switzerland has high salaries, low taxes, and the Alps. The Netherlands has … weed? rain? tax policies that violate the European Convention on Human Rights? While I hate to admit it, the Netherlands is simply not a top destination for foreign talent. Don’t get me wrong, it is a fair country, but in comparison to its competition it does not stand out (something the Dutch would probably be happy about).

Arguably, the natural conditions are difficult to change. But that only means that the Dutch must work harder on other fronts to become attractive for recruits from abroad. Unfortunately, they have been doing exactly the opposite. Some would argue that lack of foreign talent can be substituted with the local one. While this is true, it is so only to a rather small extent. It would also still require stable and high-quality governance. What part about the illegal taxation or inability to stimulate growth funding made you think it would be the case? Indeed, it is not. The Netherlands sees only 19% of its students graduate from STEM fields. That’s only about half (!) that of Germany.

Another way to motivate both local and foreign talent to go work for an early-stage company is to promise a chance of becoming (somewhat) wealthy through equity. Unsurprisingly, the Netherlands does not make this easy either. It implements unfavourable taxation schemes and regulations, lacking behind countries like France, Germany, UK and the US in the attractiveness of stock ownership plans (ranking only 14th out of 24 evaluated countries).

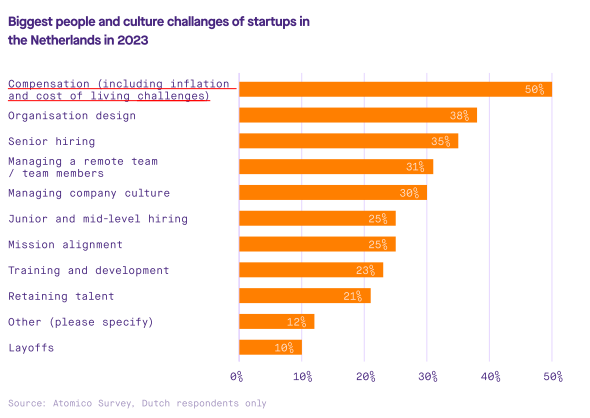

Taking all this together, it is not a surprise that the Netherlands is one of the three countries in Europe where it takes the longest to fill a job vacancy. Coming full circle, this problem becomes yet more pronounced at senior positions that require substantial expertise and adequate compensation, further slowing down company growth.

After the bad and the ugly, is there any good?

So far, I painted a dark picture. It is a realistic one and I want you to hang it in your living room. Preferably only symbolically, unless you actually have The Black Square. In that case, please consider buying me a coffee or two.

After this tirade, and the reminder that you too missed the chance of becoming fairy-tale wealthy by painting single-coloured squares, we deserve at least some encouragement. Luckily, there are a handful of good aspects that the report brings forward that we can hang onto. In particular if you are in the biotech industry. One, 29% of VC funding in the Netherlands goes to health-related startups, 13% goes to food. Both are about double the European average. 11% goes to semiconductor industry, and that’s 5-fold the European average. Two, the Dutch health, pharma and biotech sectors collected over 1B EUR funding between 2019 and 2023. Three, only 1 out of 8 patents filed by Dutch research institutions are turned into startups. This means that there is a large untapped potential for research-based venture creation.

Conclusion

The state of Dutch tech is, overall, quite gloomy. But given that you are reading this, you are probably an uncorrectable optimist or even a techno-optimist. You may also be a prospective founder. As such, where others see a problem, you see a challenge. And where there is a challenge, there may be a solution. Good for you, because this is exactly the angle we will take in the next article, where we discuss three main recommendations for improvement that the report brings forward. Stay tuned!

comments powered by Disqus